THE IMPACT OF TAX SYSTEM ON THE ECONOMIC GROWTH OF A COUNTRY

A Conceptual Research Paper

Author Name: Maryam Khan (Accounting & Finance)

laureatefolks@gmail.com

THE IMPACT OF TAX

SYSTEM ON THE ECONOMIC GROWTH OF A COUNTRY

1. INTRODUCTION

A

sound tax system is essential for the economic growth of the country. There are

interconnections between these two elements based on policy makings,

academicians, and regulatory circles. A large amount of tax revenues has

required for running economic activities efficiently in developing countries.

Tax revenues utilize both national and sub-national levels when the world has

become a global village, then imports and exports increase. It introduced a

Goods and Service Tax (GST) in many developing countries (Mcnabb, 2018).

Developing countries are facing challenges in maintaining current tax revenues

(Bird and Zolt, 2011). Tax structure and tax collection impact the economy by

tax burden. The positive and negative impact of the tax system made the

economic and tax growth more complex.

In

this research report, we are focusing on tax policies affecting economic

development. There are two significant types of tax policies: increasing and

decreasing individual income tax rates and income tax reforms (Toder and Viard,

2014). Economic growth means increasing the Gross domestic product (GDP) and

Gross National Product (GNP). Income tax is a significant source of revenue

generation. It also affects the distribution of after tax-system and on various

economic activities (Gordon, 2016).

Undoubtedly,

low tax rates show the expansion of economic development in the long-term

period. Low tax rates raise the

after-tax returns that can lead to savings and investments in the country. Low

rates ultimately cause substitution and income effects. Low tax rates are

suitable for the established economies. Otherwise, they can cause a federal

burden. Taxes are the source of Government revenue. When taxes are low, then

Government has less amount to run the economic circle of the country. This

thing is feasible for people but not for Government. Low tax rates can

positively impact the economy as people's purchasing power becomes good, but it

can reduce economic growth in the long run. So, the tax system is complex, as

it involves tax changes and low tax rates. It is a perception that tax changes

can increase the overall size of the economy.

In

this research report, we present the various tax reforms and tax systems while

affecting the country's economic growth in the eye of previous writers.

1.1

RESEARCH QUESTIONS

The

researcher aims to follow the following research question

1. What

is the role of the tax system in the economic growth of a country?

2. What

are the positive and negative impacts of the tax changes on economic growth?

3. What

are the issues a country can face with tax-return policies?

1.2

RESEARCH OBJECTIVES

The

current study involves the following objectives given research questions.

·

To explore the importance of tax in

economic growth in the eye of current analysis and past research literature.

·

To explore the positive and negative

impacts of tax policies in an economy

·

To analyze the various issues a country can,

face while changing its tax policies

·

To investigate the income tax effect on

individual lives

·

To examine the role of the Government in

making a tax system.

·

To explore the future implications

regarding tax policies in the economic growth of the country.

1.3

SIGNIFICANCE OF THE STUDY

·

The current study aims to explore the

significant impact of the tax system on countries' economies. The study is

essential in many ways.

·

This study may help demonstrate the

unique tax policies f various countries.

·

The study may help motivate people to make

investments when there are low tax rates.

·

This study may be helpful for the

Federal fiscal department to acknowledge issues and crises led by the flawed

tax system.

·

The study may be helpful for the reader

to get aware of the importance of income tax effects in one's lifestyle.

·

The current study is unique as it shows

both positive and negative impacts on the economy.

2.

THE BACKGROUND AND SCOPE OF THE STUDY

While

looking for the background of the study, we found that the tax system has been

running from ancient eras. But now, it is developed in today's digital world.

Here we are presenting an extensive literature review in the eye past research

studies conducted by experienced writers.

With

the Biden organization proposing many new expenses, it merits analyzing how

duties impact the monetary turn of events. We directed a survey of the

information in 2012, noticing that most of the examination discovered

troublesome impacts. Be that as it may, various studies have been distributed

from that point forward, some of which utilize further developed practical ways

to decide the causal impact of charges on the monetary turn of events. This new

proof, which affirms our past decisions, is examined underneath: Taxes,

especially those demanded on business and individual pay, smother financial

advancement.

The

effect on the GDP rate by changing tax policies is hard to evaluate as various

other circumstances affect the overall economic activity. Sometimes tax policy

changes as a result of a change in monetary policy. It becomes a dependent

variable here. When the substitution effect rises, Government increases the

import and export duties. Therefore, most of the writing lately has taken on

this strategy, as examined underneath (Roomer and Romer, 2010). Looking at

unforeseen changes in charge strategy alluded to viewed by financial experts as

"exogenous shocks."

There

are other methodological issues to consider. Inability to represent different

factors affecting financial development, like government consumption and

money-related arrangement, may bring about an odd take on the cold, hard truth

or exaggeration of the impact of duties on development. Some assessment

changes, for example, partnership charge increments, may have more since quite

a while ago run impacts than short-run impacts, and an examination with a

confined time series may neglect this impact. At last, charge changes have many

moving parts: Certain expenses might be raise, while others might diminish.

Therefore, it may be hard to recognize a few changes as net duty increments or

cuts, prompting a wrong view of how assessments influence development.

We

look at articles distributed in significant financial aspects diaries and

National Bureau of Economic Research (NBER) working papers during the most

recent couple of years, considering both homegrown and unfamiliar proof. This

review looks at a broad scope of expenses, like pay, utilization, and company

tax collection. Each of the seven articles assessed here finds that tax breaks

support development, while a few papers underline that this effect's size

changes depending on which charges are brought down, for whom, and when.

The

specialist assessed the impacts of nominal duty rates on individual pay

utilizing time-series information from 1946 to 2012. They found that a

negligible rate decrease brought about gains in genuine GDP just as diminishes

in joblessness. The GDP rate has increased by 0.78% due to a change in taxation

policy. It shows that the positive GDP upgrades found by the creators are the

consequence of changes in motivators instead of an expansion in total interest

through the utilization channel. Tax breaks for the top 1% affect other pay

classifications, which is reliable with a stock side account of how lower top

minimal rates might raise income for different gatherings after some time Tax

breaks for the top 1%, then again, advance disparity (Mertens and Olea, 2018).

From

1950 to 2011, a specialist examines the impact of government taxation rates on

financial development and work supply across various pay gatherings and states.

He finds that tax reductions affect economic development two years after the

approach change. However, tax breaks for low-and moderate-pay citizens

significantly affect development than tax breaks for top-level salary citizens.

The report indicates that a 1% decrease in state GDP charges for the least

fortunate 90% of pay raises state GDP by 6.6 percent. Taking a gander at work

supply impacts, he finds that a 1% decrease in state GDP charge supports

workforce cooperation for the least fortunate 90% of profit by 3.5 rate focuses

and hours worked by 2%. Rather than the discoveries of Mertens and Olea (2018),

he investigates the workforce investment, duty hours, incentives, and overall

GDP rate resulting from a change in tax policy (Zidar, 2019).

This

end might persuade some to think that Zidar recognizes "Keynesian" or

total interest effects of expense increments. Nonetheless, the examination

exhibits that tax reduction altogether affects genuine profit too. As per

Zidar, "the increment in genuine wages infers that supply-side responses

to burden changes are significant and may offset request side reactions for the

most minimal 90%." Furthermore, some might guarantee that this examination

shows that tax reductions for big-league salary people have no impact on development.

Be that as it may, this examination thinks about the short-run effects of duty

changes on GDP and doesn't address the since a long time ago run impacts of

expense strategy on development, human resources, or advancement. Regardless,

the examination presents persuading proof that tax breaks impact development,

which is reliable with the neoclassical financial hypothesis.

A

specialist analyzed 250 state company charge changes between 1970 and 2010 to

decide their effect on work and pay. By looking at contiguous districts across

states, the creators can separate the impacts of organization charge expansions

comparable to different strategies that might affect economic development. They

find that bringing down legal enterprise charge rates by one rate guide leads

to a 0.2 percent ascend in business and a 0.3 percent increase in profit. They

find that assessment climbs are almost consistently negative, though tax breaks

seem to have the best specific impact during downturns. Similar to a few of the

different examinations portrayed here, the article centers around short-run

effects, even though almost certainly, these beneficial impacts might grow

throughout a more drawn-out time skyline (Ljungvist and Smolyansky, 2018).

Experts

research the impacts of significant worth added charges (VAT) on monetary

improvement utilizing information from 51 countries from 1970 to 2014. They

find that the effect of charges on development is exceptionally nonlinear. The

results are nil for low rates with minor changes; however, the monetary damage

increments with a more special gauge charge rate and more incredible rate

changes. Subsequently, ascends in VAT in nations with high VAT rates, like many

industrialized Europe, will significantly affect GDP than climbs in low VAT countries.

These non-linearities propose that Laffer bend impacts are enormous: Further

climbs at some duty rates will decrease Government charge assortments. The

creators gauge an expense multiplier of - 3.6 for European industrialized

countries two years following a duty change, suggesting that tax breaks

significantly support monetary movement in these nations (Gunter et al., 2019).

From

1973 through 2009, scientists analyzed the impacts of individual pay, business,

and utilization charges in the United Kingdom. They find that annual tax

breaks, characterized in their review as unique and enterprise pay, affect GDP,

private utilization, and speculation. A 1% decrease in the average personal

duty rate helps GDP by 0.78 percent. The effects of utilization charge decrease

are humble and didn't make genuinely huge impacts. However, the examination

reasons moving from pay to a utilization charge base beneficially affect

development. Utilization charges are ordinarily seen as less distortive than

different sorts of tax assessment since they have little impact on the

motivations to work and contribute that are basic for keeping up with since

quite a while ago run financial development (Nguyen et al. 2021).

Investigators

look at the U.K.'s interwar period, 1918-1939, a period of high obligation and

low loan fees, to all the more likely comprehend the impact of duties on the

monetary turn of events. At that point, the British expense framework was, for

the most part, included extract charges on liquor, tobacco, and engine

vehicles, with pay and business profit burdened less significantly. Since this

period originates before the approach of Keynesian macroeconomic hypothesis,

charge measures were commonly not expected to be countercyclical, but instead

to adjust the spending plan, diminish imbalance, or lift efficiency. The

creators find that a one-rate point quit raising in government expenditures as

an extent of GDP expands GDP by 0.5 to 1%, ascending to 2% following one year.

While the British economy a century prior contrasted extraordinarily from

current economies, this review gives persuading proof regarding how assessments

influence development in high obligation and low loan cost circumstances

(Cloyne et al., 2018).

Scientists

are leading a meta-examination of the effect of assessments on development in

OECD countries. Their example comprises 979 evaluations drawn from 49

explorations. Not at all like different examinations tended to in this survey,

this one considers both the effects of tax collection and consumption on

development. The creator's sort strategy changes into three kinds: charge

negative monetary arrangements, charge positive financial system, and

assessment questionable economic approaches. Assessment climbs to help in

effective ventures or expansions in distortionary charges matched with a drop

in non-distortionary orders are instances of expense negative financial

strategies. Estimate rises to fund helpful speculation, decreases in

distortionary burdening compared with expansions in non-distortionary tax

collection, or duty increments to bring down the shortfall are instances of

expense positive financial strategies. Expense uncertain economic approaches

are ones in which the absolute monetary effect is obscure. Utilizing these

classes, the creators find that a 10% decrease in charges from an expense

negative economic bundle supports GDP development by 0.2 percent. The

equivalent estimated tax reduction for payment well disposed monetary measures

diminishes GDP development by 0.2 rate points (Alinaghi and Reed, 2021).

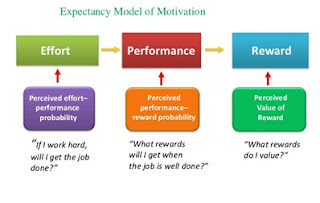

Figure 1: Impact of tax system in

economic growth

2.1

THEORETICAL FRAMEWORK

Undoubtedly,

changes in tax rates may affect the overall economic activities. So, we are

exploring the effects that come in lowering and increasing income tax rates.

2.1.1

Reduction in the Tax rate

Reducing

Income tax rates may affect individuals and corporate. Tax breaks impact the

development of the economy since they increment the after-tax reduction for

working, saving, and contributing. Through replacement impacts, these more

substantial after-tax reductions drive expanded work exertion, saving, and

venture. One more advantage of unadulterated rate decrease is that they lessen

the benefit of existing expense mutilations and incite productivity. Further

developing change in the blend of monetary movement away from right now charge

supported areas like wellbeing and lodging (in any event, when the volume of

financial action stays steady). Be that as it may, an unadulterated rate may

have a positive pay (or abundance) impact, decreasing the need to work, save,

and contribute (Arnold et al., 2011). A

general decrease in personal assessment rates, for instance, consolidates these

advantages. It raises the minor re-visitation of business, boosting work supply

using the replacement impact.

2.1.3

Financing

Tax

policies affect not only economic development but also the decisions of

government spending. The fundamental approach is to get maximum tax revenue so

that Government can bear its expenditures. The Government uses many high

budgets with tax revenues and debts paid from this revenue. When the Government's

financial needs are fulfilled, subsidizing duties cannot create more deficits.

Decreasing tax rates rely on the Government's current debt (He

et al., 2011). In the past, the tax reduction depended on the capital

reserves of the country. Tax rates increase when a government takes more loans

for the development of the country. An increase in debts causes an increase in

tax rates. These changes may increase or decrease the public savings and

capital reserves in the country. In short, when the Government raises financing

through loans and debts, tax rates rise, and there is a lack of economic

development.

2.1.4

Other Governmental Organizations

Other

legislative associations, like the national bank, state governments, and

foreign governments, may react to bureaucratic expense decrease. For instance,

the Joint Committee on Taxation (2014) examines what elective Federal Reserve

Board arrangements may mean for the effect of Representative Camp's duty change

thoughts on the monetary turn of events. Unfamiliar nations' potential

reactions are much of the time ignored. Tax breaks in the United States, for

instance, that advance capital inflows from outside, may move different

countries to bring down their assessments to hold capital or draw in U.S.

reserves. On the off chance that other countries react, the net impact of

personal tax reductions on development will be lower than it would be something

else.

3.

EMPIRICAL ANALYSIS

"Financial

development" can apply to something like three different thoughts. The most

basic definition is that economic development is the consistent state pace of

development that emerges from an organic market financial model after some

time. This thought is excessively restricted for our motivations since it

ignores any development during the (possibly extended) progress between a

consistent state under one assessment system and the constant state to which

the economy joins following an adjustment of expense strategy. The amplest

definition is any adjustment of the measure of monetary action all through any

timeframe. This idea supports appraisals of the capacity of duty changes in

adjustment strategy to streamline financial varieties at business cycle

frequencies, certainly if not plainly. Given our focus on the stock side of the

economy, this idea is excessively expansive. The measure of financial action

might develop throughout brief timeframes as, for instance, tax breaks to

adjust actual and potential GDP instead of raising potential GDP.

Another

idea, middle of the road between the past two, considers any adjustment of

financial movement across time spans longer than the business cycle. It may be

something that invigorates the economy on a one-time, long-lasting premise,

something that changes the economy's consistent state development rate, or

something that does both. For an assortment of reasons, restricting

thoughtfulness regarding longer ranges of time is adequate. First of all,

investigating more extended periods adjust the impact of expense strategy

throughout the business cycle. It portrayed re-enactment examinations

underneath; tax breaks might have a positive short-run impact on monetary

movement. However, a negative since a long time ago run impact when higher loan

costs from the subsequent shortages muffle other financial activities. Third,

focusing on a more drawn-out period guarantees that the full effect of duty

changes consider. A starter takes a

gander at verifiable information from the United States. The 11 cross-country

insights on development rate incongruities between countries show no generous

connection between financial development and personal assessment strategy.

3.1

Variations in taxation and growth

The

utilization of the GRD, which gives a significantly more broad and solid type

of revenue information than some other single source, is one of the review's

primary forward leaps, especially for non-industrial countries. It is refined

by systematically consolidating data from various global sources, including the

IMF's GFS and OECD Revenue Statistics, just as information from the IMF's

Article IV Staff Reports. The GRD likewise exhorts clients when considering

perhaps befuddling or off base, determined to try not to delude concentrate on

outcomes. It includes 6390 perceptions for 196 countries from 1980 to 2012/2013.

However, for various reasons, the econometric investigation utilizes a more

modest example of this information. An imbalanced time series for every country

included is needed for the PMG assessor to unite. The model is restricted to

countries with 20 years of continuous information, guaranteeing that the t

measurement is adequately long. Last, perceptions that have been set apart as

conceivably unsafe likewise dispensed.

At last, the investigation is restricting by

the absence of extra factors. The previous example for the econometric review

incorporates 2657 perceptions from 100 distinct countries.

4.

CONCLUSION

For economic

development, a fair and justified tax system is essential. Economies can

destroy if they lack good monetary and fiscal policies. Tax is an excellent

source of generating revenues and Government-run the country's expenses from

this revenue. With the Globalization of this world, many countries have become

open trade zone. It led to import and export duties. These duties increase with

time as the trade has boosted. A government gets excellent benefits while

applying import and export duties. It is on one side of the picture.

The other side of

the picture is by increasing tax rates, poverty rises, especially in developing

counties. Countries at the breakeven point of the poverty line and below the

poverty line are going through the worst economic conditions while increasing

tax rates. So, to avoid these crises, base tax is significant. The base tax

rate should be keeping that level where everyone can pay it off. Economies will

develop if the base tax rates are justified.

Similarly, if the

tax rates are low, then consumers show the substitution of the income effect.

The people have more purchasing power. They can save or invest the money. If

the investments increase, then it will increase the overall GDP of the country.

So, it will show a positive impact on the economy. So, a balanced tax system

can keep the economy at a boom period. For this purpose, Government has too

fiscal solid and Monetary policies.

5. FUTURE RECOMMENDATION

Here are a few

recommendations for future implications and researcher.

·

The tax system should be according to the poor in

the country

·

The Government should have a strong team for the

collection of taxes. If someone is not paying tax on time, penalties and

punishments should impose to maintain discipline in the country.

·

Government should exempt the poor from tax.

·

The tax policies should review quarterly as per the

external factors.

·

Taxes should be exempt from the necessary items like

milk, sugar floor, etc.

·

Taxes should be higher for luxury items so that a

good amount of revenue can generate.

·

Future Researchers should investigate the best tax

system countries and explore their success stories so that others can benefit

from them.

REFERENCES

Charlie McNabb.

(2018). impact of tax system. The Journal of American Folklore, 131(521),

360.

Bird, R. M., &

Zolt, E. M. (2011). Dual Income Taxation: A Promising Path to Tax Reform for

Developing Countries. World Development, 39(10), 1691–1703.

Toder, E., &

Viard, A. D. (2016). REPLACING CORPORATE TAX REVENUES WITH A MARK-TO-MARKET TAX

ON SHAREHOLDER INCOME. National Tax Journal, 69(3), 701–731.

Gordon, R.,

Joulfaian, D., & Poterba, J. (2016). Estate Tax Complexity Illustrated by

the 2010 “Voluntary” Estate Tax. The Journal of Wealth Management, 19(1),

27–33.

Romer, C. D., &

Romer, D. H. (2010). The Macroeconomic Effects of Tax Changes: Estimates Based

on a New Measure of Fiscal Shocks. American Economic Review, 100(3),

763–801.

Mertens, K., &

Montiel Olea, J. L. (2018). Marginal Tax Rates and Income: New Time Series

Evidence*. The Quarterly Journal of Economics, 133(4), 1803–1884.

Zidar, O. (2019). Tax

Cuts for Whom? Heterogeneous Effects of Income Tax Changes on Growth and

Employment. Journal of Political Economy, 127(3), 1437–1472.

Lim Young-Kyu, & 김영락.

(2018). The Effect of Taxpayer Characteristics on the Tax Consciousness and Tax

Compliance Action of National Tax and Local Tax. Tax Accounting Research,

null(56), 1–25.

Cairat, M., al

Rhamoun, M., Gunter, M., Severi, G., Dossus, L., & Fournier, A. (2019).

Utilisation d’anti-inflammatoires non stéroïdiens et risque de cancer du sein

dans une cohorte prospective de femmes ménopausées. Revue d’Épidémiologie et

de Santé Publique, 67, S188.

Et. Al., P. S.

(2021). Tax Rates Variations And Its Effect On Individual Tax Payers A Research

Focussed On Salaried Class People In India. Turkish Journal of Computer and

Mathematics Education (TURCOMAT), 12(2), 3268–3274.

Cloyne, J. (2018).

Brexit: New Evidence and Policy Perspectives. Fiscal Studies, 39(4),

549–553.

Alinaghi, N., Creedy,

J., & Gemmell, N. (2021). Designing Personal Income Tax and Transfer

Reforms: Alternative Modelling Approaches. Australian Economic Review.

Published.

Arnold, J. M., Brys,

B., Heady, C., Johansson, S., Schwellnus, C., & Vartia, L. (2011). Tax

Policy for Economic Recovery and Growth. The Economic Journal, 121(550),

F59–F80.

He, J., Wang, X.,

& Ma, Z. H. (2011). On Risk Factors of Inventory Finacing Based on

Structural Equation Model. Applied Mechanics and Materials, 58–60,

674–679.

Comments

Post a Comment